What is a spread in the derivatives market?

Article reviewed by

Raphael Bulascoschi

—

Market Intelligence Analyst

In the derivatives marketplace, spreads refer to the price differences between two related assets or contracts. This could be the price difference between:

- Contracts for similar products, e.g. different types of crude oil

- Identical products traded on different exchanges, e.g. gold futures on COMEX vs. NYMEX

- Contracts for the same products traded on the same exchange, but with different expiration dates, e.g. near-term vs. long-term contracts for crude oil.

Spreads trading involves capitalizing on these price differences through various strategies. The primary types of spreads are:

- Intermarket spread: This involves trading the same underlying asset across different exchanges to capitalize on price discrepancies. For example, buying a commodity future on one exchange and selling it simultaneously on another.

- Intracommodity spread: This focuses on futures contracts for the same commodity, but with different expiration months. For example, purchasing a crude oil futures contract with a near-month expiry and selling a later-month contract at the same time.

- Intercommodity spread: This involves trading related but different commodities. For example, leveraging price correlations between silver futures and gold futures.

- Calendar spread: This involves trading the same stock or commodity with different expiration dates.

- Options spreads: This involves simultaneously selling and buying options contracts on the same underlying asset to profit from different strike prices.

- Bid/ask spread: This is the difference between the price a buyer is willing to pay (bid) for an asset and the lowest price a seller is willing to accept (ask).

- Credit spread: This refers to the difference between the yield of two debt instruments with the same maturity but different credit ratings.

In this glossary definition, we will focus on the calendar spread – also known as horizontal spread or intramarket spread.

The calendar spread is calculated as the price difference between the nearest-expiring contract and the further-out contract. It can be calculated for any pair of contracts for the same product. If the nearer expiration contract is cheaper than the farther-out one, the spread is negative, and vice versa.

For example, if the August and September Brent crude oil contracts traded on ICE Futures Europe are priced at $61.40 and $60.54 per barrel, respectively, the spread would be +$0.86 per barrel ($61.40 - $60.54 = $0.86).

Spreads for a given asset can be visualized graphically through the ‘forward curve’, where the horizontal axis represents contract expirations (from nearest to farthest) and the vertical axis shows the lot prices. A positively sloped curve, where further-out contracts are priced higher than nearer ones, indicates negative spreads, and vice versa.

What determines the spread in commodities markets?

The spread in commodities markets is influenced by several factors, the most significant of which is the ‘cost of carry’. This refers to the expenses incurred when sellers hold a commodity for future sale rather than selling it immediately.

Cost of carry

The cost of carry typically includes:

- Cost of money: Money today is worth more than money tomorrow. To defer payment, sellers often demand a higher future price, which is roughly equivalent to the interest rate on a financial instrument with similar risk and maturity.

- Storage costs: These include expenses like rent, insurance, and other fees required to store the product until its future sale date. Even warehouse owners face an opportunity cost if the space could be rented out to others.

In other words, the cost of carry is roughly equal to the sum of interest and storage costs. Since these costs are usually positive, the future price in a ‘normal’ market situation tends to be higher than the spot price, resulting in a negative spread. This dynamic creates a positively sloped forward curve, also known as a ‘normal curve’ or ‘carry market’. On the other hand, a negatively sloped curve, where the spread is positive, is called an ‘inverted curve’.

Market dynamics

While the cost of carry plays a large role in determining spreads, market conditions can also cause fluctuations. For example, there can be:

- Oversupply: When there’s an excess of inventory, storage space becomes scarce and increases costs. This can cause the spot price to trade at an unusually large discount to futures, resulting in a steeper-than-usual curve and smaller spreads.

- Scarcity: When there’s a product shortage in the spot market, buyers may pay a premium for immediate delivery. This can result in an inverted curve, where the spread becomes positive (a negatively sloped curve).

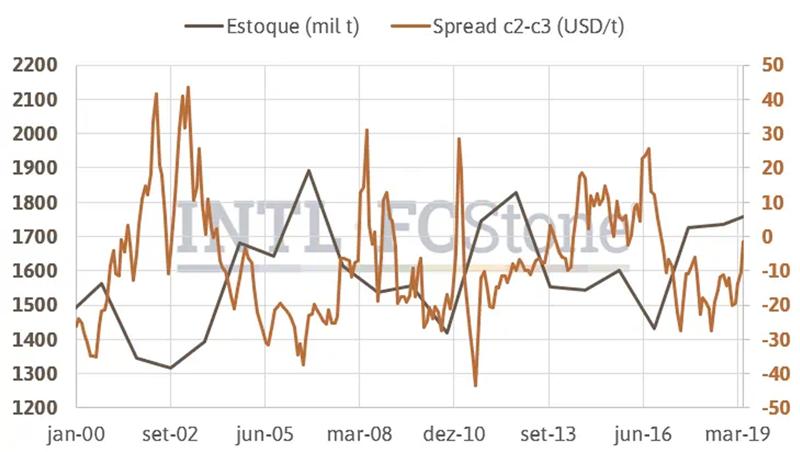

In essence, spreads are closely tied to inventory levels, and for further-out contracts, to expectations of future changes in supply and demand. This inverse correlation is seen in the chart below, which compares global cocoa inventory estimates with the spread between the second- and third-nearest delivery contracts traded on ICE New York.

Source: ICE Futures US, ICCO- Cocoa stocks and calendar spread.

Seasonal patterns

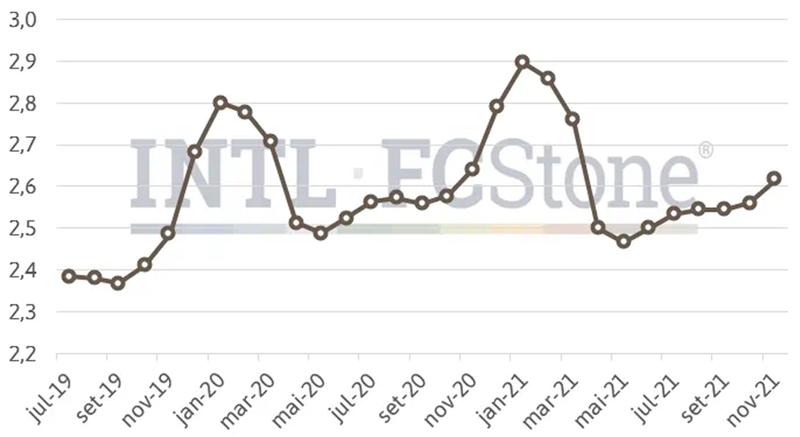

Some markets also have clearly defined seasonal inventory patterns which influence their forward curves. For example, the U.S. natural gas market experiences an ‘injection season’ in summer (when heating demand is low) and a ‘withdrawal season’ in winter (when consumption spikes due to cold weather). This seasonality is seen in the chart below, which reflects the forward curve for Henry Hub natural gas traded on NYMEX.

Source: ICE Futures Europe- Brent oil futures curve.

Other factors

While most commodities tend to operate with negative spreads due to the cost of carry, some markets oscillate between ‘normal’ and ‘inverted’ curves without preference. Examples include the cocoa and cotton markets, where spreads fluctuate based on factors like lower stock-to-use ratios, higher inventory variability, product perishability, a higher relative share of producers (or sellers) amongst hedgers, seasonality, and others.

The role of spreads in hedging and risk mitigation for businesses

Businesses can use calendar spreads to hedge against commodity price volatility by locking in the price difference between near-term and long-term contracts, helping manage future price fluctuations.

For example, a coffee farmer might sell a near-month coffee futures contract to secure a price for their upcoming harvest, while simultaneously buying a far-month contract to hedge against potential price fluctuations.

The near-month contract locks in the current price, while the far-month contract helps the farmer manage the risk of price changes over time. This strategy can provide the farmer with more predictable revenue.

If coffee prices drop in the short term, the gain from the longer-term contract can potentially offset some of the losses. If prices rise, the farmer has locked in a price that offers stability, helping protect against market volatility.

How do index funds contribute to distortions in spreads?

Index funds aim to mirror the performance of a benchmark index by maintaining portfolios of assets in fixed proportions based on the weight of each asset in the underlying index. Unlike actively managed funds, which adjust their trades based on price expectations, index funds strictly follow predefined rules to track their benchmark.

In commodity markets, index funds often replicate the performance of major indices like the S&P GSCI and CRB by taking positions in futures contracts. These indices have specific rules about which futures contracts to include, typically focusing on the most liquid contracts for each product – which are usually those closest to expiration.

This trading behavior impacts spreads in two ways:

- Concentration in nearby contracts: Index funds concentrate their trading activity on the nearest-expiring contracts due to index rules and liquidity preferences. This can lead to imbalances in demand or supply, potentially causing spreads to widen or narrow – changes that might not reflect the actual fundamentals of the underlying commodity. Instead, these distortions often reflect broader investor sentiment toward the asset class.

- Rolling Contracts: As futures contracts near expiration and begin to lose market liquidity, index funds roll their positions into the next-nearest contracts. This involves selling the expiring contract and buying the next one, a process known as ‘rolling’. Rolling can exert downward pressure on spreads and further distort the price difference between the two contracts.

Commodities where index funds hold relatively large positions – compared to actively managed funds and commercial hedgers – are more susceptible to spread distortions. Examples include cotton, wheat, and sugar.

How do spreads trading strategies help manage market risk?

Spread strategies provide a way for businesses to manage market risk by mitigating their exposure to price fluctuations. Below is an example of how this might work.

Consider an oil refinery (Refinery X) that plans to purchase crude oil for processing into gasoline and diesel. In January 2025, crude oil futures are trading at $75 per barrel, while March 2025 futures are priced at $77 per barrel – a $2 spread per barrel.

Refinery X knows it will need crude oil in March, but is concerned about price volatility in the months leading up to that time. They have two choices:

- Buy January crude oil futures now and store the oil until March. In this situation, they’ll need to pay storage costs of $1.50 per barrel for the two months.

- Buy March crude oil futures directly. This avoids storage costs but can leave the company exposed to potential price increases in crude oil before March.

To mitigate this risk, Refinery X enters a calendar spread trade:

- They sell January 2025 crude oil futures at $75 per barrel

- They buy January 2025 crude oil futures at $77 per barrel.

This locks in the $2 spread between January and March contracts. If the spread widens to $2.50 per barrel, the value of the March futures position increases relative to the January futures, benefiting the refinery. If the spread narrows, any losses on the March position are offset by gains on the January position.

By using a calendar spread, Refinery X has ensured that the cost of purchasing crude oil in March remains predictable and aligned with their operational needs. This helps lock in predictable costs for the refinery, protecting them from price fluctuations and aligning their operations with the realities of the market.

Access expert insights into commodity markets

Successful derivatives trading relies on access to accurate and timely information that can guide decisions and risk management strategies.

StoneX Market Intelligence provides comprehensive reports and analysis on various commodity markets. Our expert insights and data-driven analysis can help traders and investors to identify opportunities, stay ahead of market trends, make informed decisions, and manage risk.

Explore our Market Intelligence offerings and subscribe today to gain a competitive edge in the commodities market.

This material is for informational purposes only and should not be considered as an investment recommendation or a personal recommendation.

See why StoneX is a partner of choice

Have questions about our products or services? We're ready to help.

StoneX: We open markets

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

Reach

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2025 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.