- Brazilian GDP growth is expected to lose momentum in the second quarter, which could dampen investors' appetite for Brazilian assets and weaken the BRL.

- China's economy may continue to show signs of an economic slowdown and difficulties in its real estate sector, dampening foreign investors' appetite for risk assets and weakening the BRL.

- Data for the US economy is expected to show that prices continued to moderate in July while growth and the labor market remained resilient, easing interpretations that further rate hikes will be needed and contributing to the dollar's weakening.

- Possibility of ministerial reform in the Lula government would expand the legislative base of the government. It may increase investors' optimism about Brazilian assets, strengthening the real.

The week in review

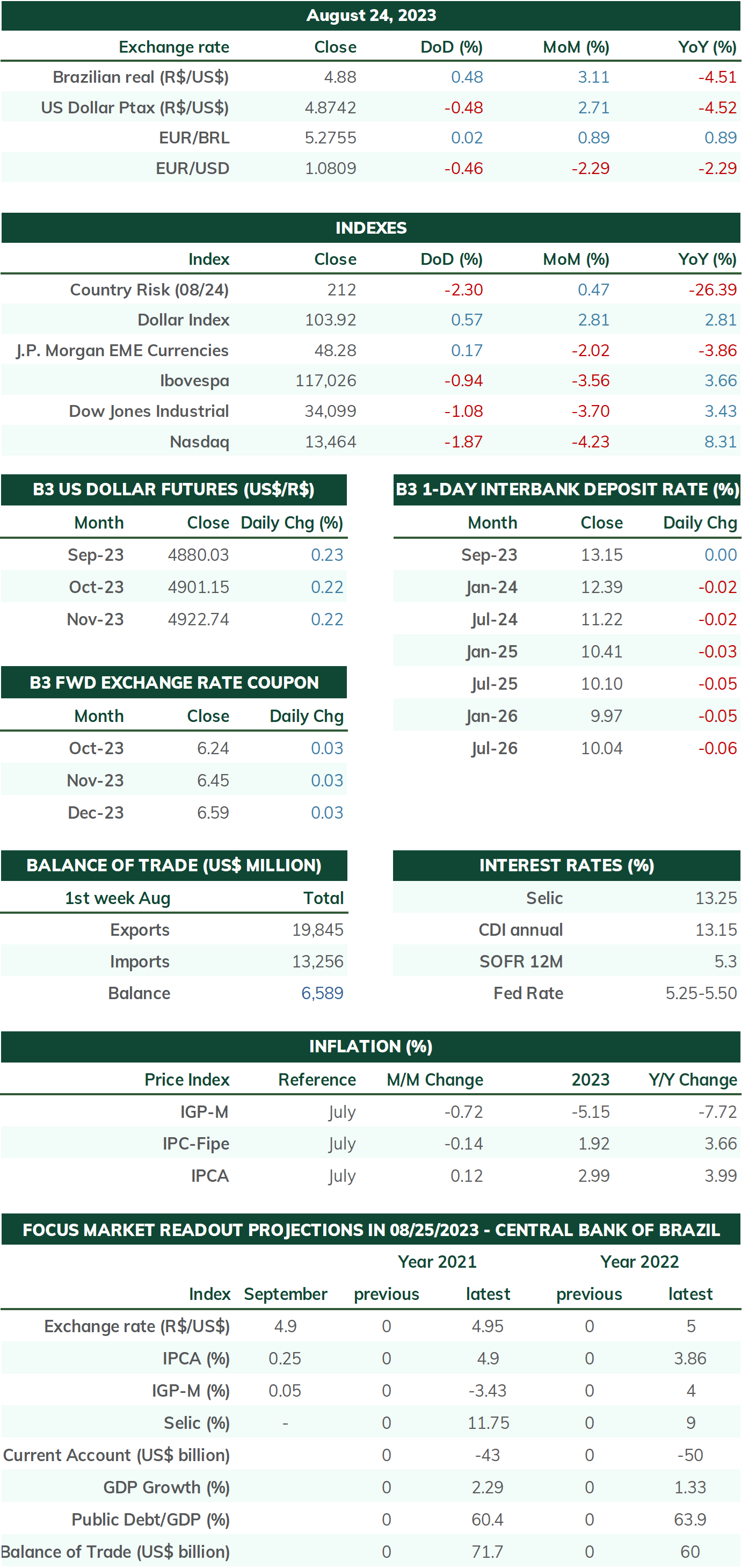

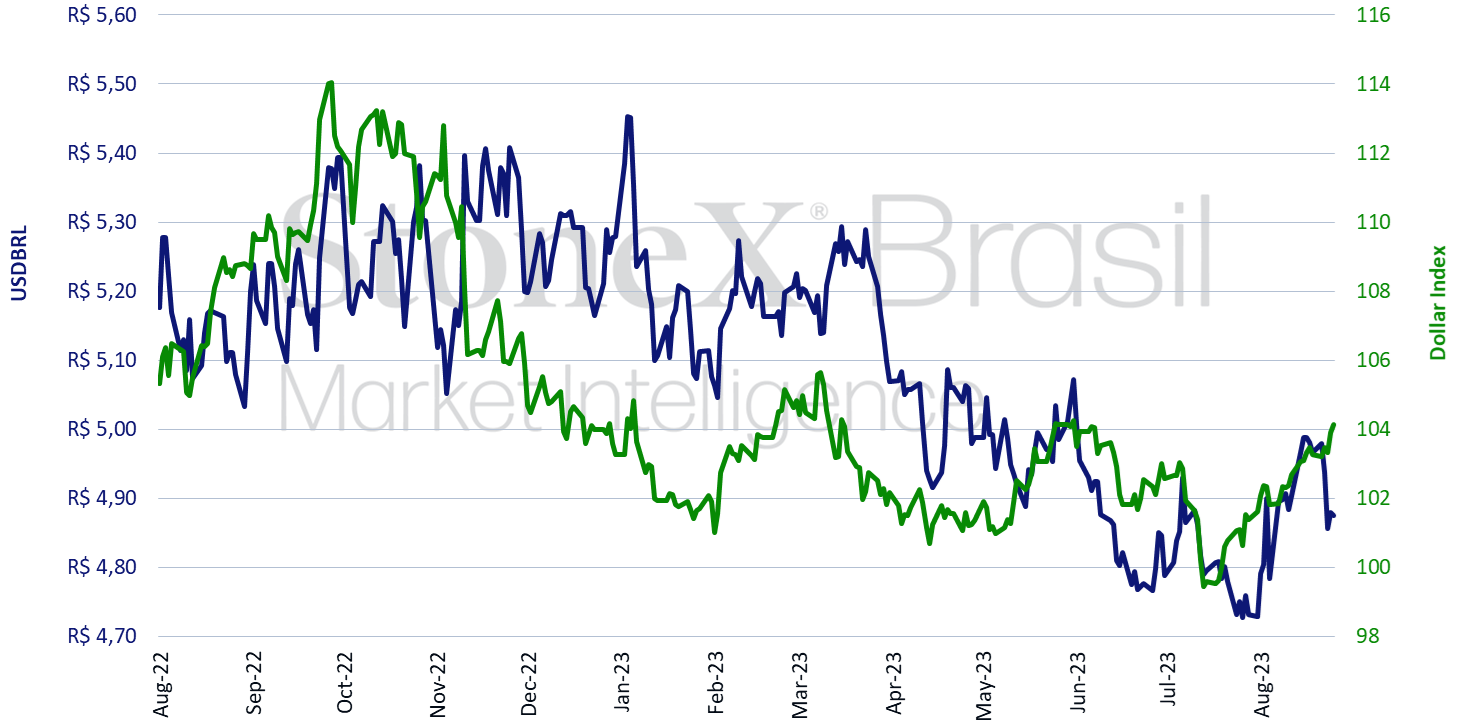

The USDBRL ended the week lower, ending Friday's session (25) quoted at BRL 4.875, a change of -1.8% in the week, +3.1% in the month and -7.7% in the year. The dollar index closed Friday's session higher for the sixth consecutive week, quoted at 104.2 points, a weekly gain of 0.8%, a monthly gain of 2.5% and an annual gain of 0.9%. The currency market echoed Jerome Powell's speech in Jackson Hole, the final approval of the fiscal framework in Congress and lingering concerns about the Chinese economy.

Expected impact on USDBRL: bearish

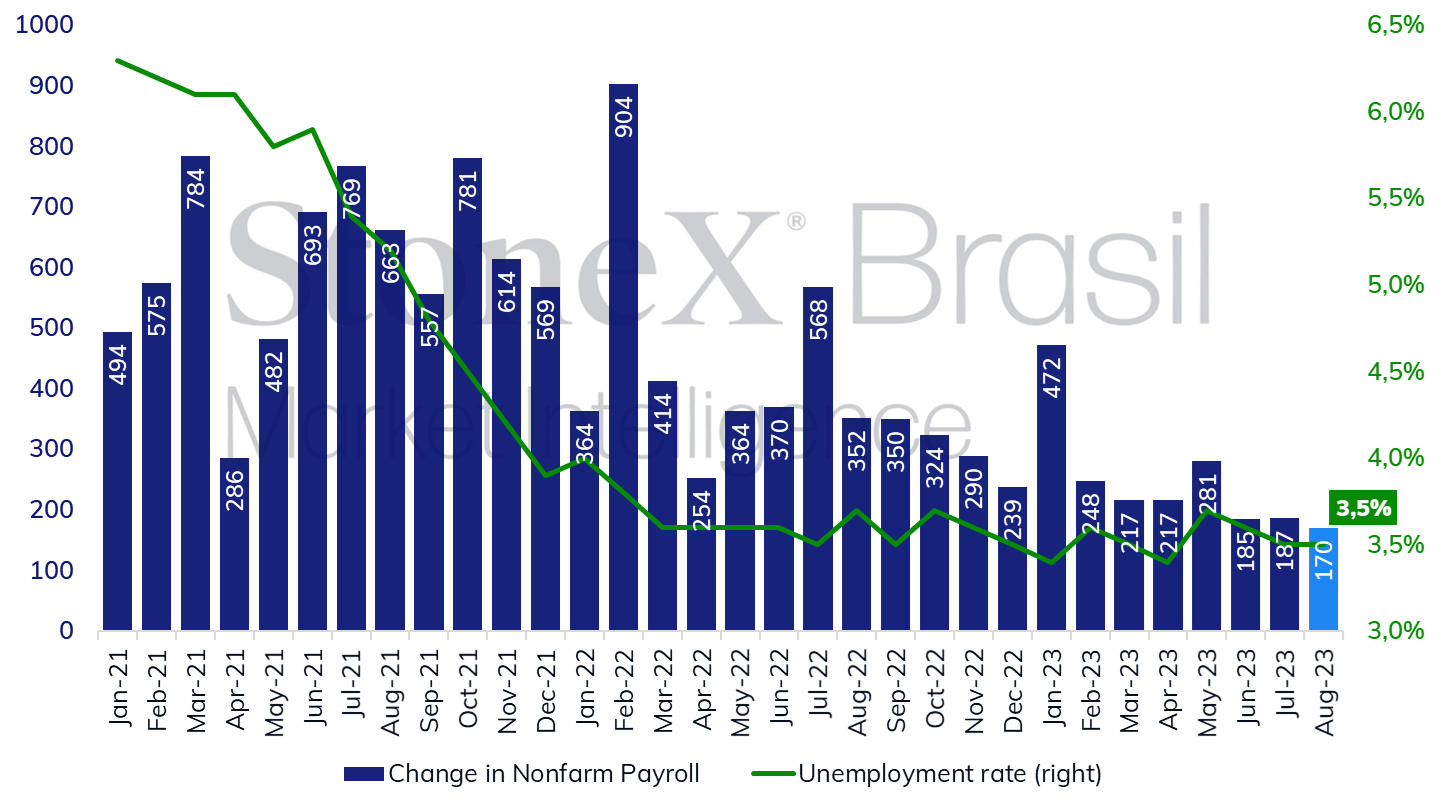

The investors' attention this week is expected to be on the abundant release of economic indicators for the United States, with readings for economic activity, the labor market and consumer prices. This week, the release of the Employment Situation Report for August should show that the creation of new jobs remains in positive territory but in mild moderation compared to previous months. There are small signs of a slowdown in the labor market, such as a drop in the number of temporary workers and a decrease in the average weekly hours worked, but these are still discrete and do not allow us to say that the shortage of workers has decreased.

In addition, the August Personal Consumption Expenditure (PCE) Price Index will be released, the most widely used metric by the Federal Reserve to track consumer inflation, with the expectation of a new moderate reading for the third consecutive month, with an expectation of growth of approximately 0.20% for both the full index and its core. However, the prices of services excluding rent (called super core services) may increase slightly, around 0.40%. Some Fed officials have highlighted the influence of this segment of services on the recent inflationary trend, and a slightly higher rise in this group may motivate the institution's members to maintain a more cautious stance in the upcoming rate decisions.

The second preview for the Gross Domestic Product of the United States for Q2 2023 will also be released, with the expectation of a revision of growth from 2.0% to 2.4% at an annualized rate. Finally, August's industrial Purchasing Managers' Index (PMI) will be published, with an expected retraction (i.e., a reading below 50 points) for the tenth consecutive month, continuing the negative performance of American manufacturing activity.

Expected impact on USDBRL: bullish

Brazilian GDP growth is expected to lose momentum significantly in the second quarter, going from a growth of 1.9% against the immediately previous quarter to only 0.3%. Agriculture is expected to shrink, offset by modest growth in industry and services. The data should show that the Brazilian economy has some resilience but that the more restrictive macroeconomic environment, with high interest rates for a long time, has reduced the capacity for a more robust expansion.

Expected impact on USDBRL: bearish

After the important approval of the Complementary Bill of the fiscal framework (PLP 93/2023) this week and the Provisional Measure that readjusts the minimum wage by the National Congress, the focus falls on the promised and constantly postponed ministerial reform in the government of Luiz Inácio Lula da Silva that would seek to accommodate more space for parties of the so-called "Centrão." According to O Globo newspaper, Brazil's President is expected to promote the changes this week when he returns from international commitments.

After the dissatisfaction of deputies with criticism made by the Minister of Finance, Fernando Haddad, to the Chamber of Deputies, the meeting of party leaders to discuss the vote on the Bill of the fiscal framework (PLP 93/2023) was postponed to this Monday (21). If there is agreement, the vote could be taken as early as this week. The text approved in the Federal Senate was different from the one approved by the Chamber and, therefore, the procedural rite requires that the deputies analyze only the amendments to the project, that is, the points modified by the senators, accepting the suggestions or returning to the text initially approved in the Lower House. However, some political analysts question this possibility due to the constant postponements of the ministerial reform in the Luiz Inácio Lula da Silva government that would seek to accommodate more space for parties of the so-called "Centrão" (center-right coalition).

Expected impact on USDBRL: bullish

The release of China's official Purchasing Managers' Indexes (PMI) for August should show the slowing trend of economic activity in the country, both for services, which are expected to grow slightly and for industry, which is expected to retract gently. Amid a string of lower-than-expected indicators for Chinese economic growth and uncertainties about the stability of the real estate sector, such readings could deepen investors' pessimism about the country's recovery prospects and hurt the performance of risky assets such as the Brazilian real.